What are the tax implications of hiring remote employees?

With different tax regulations for federal, state, and local taxes, the computation is a headache. You may find yourself facing unexpected tax burdens.

The Covid-19 pandemic has triggered the era of remote work. Sure, remote work has been on the rise in the last few years. But the all-out global pandemic pushed it into overdrive, and overnight we moved to remote working.

The initial part of dealing with a fully remote setup was the technology infrastructure. We all remember the ‘can you hear me’ Zoom calls of the first few weeks, don’t we? But we were quick to adapt to the needs of the unprecedented situation. Our remote work tech stack is now sorted out, more or less.

But then came something we hadn’t really thought about – tax implications of remote work. Now taxes are already a pain when you have to figure them out under normal conditions. Under the duress of a pandemic and such a difficult time being a business, it’s a nightmare.

Before the pandemic, most businesses wouldn’t have spent any time thinking about the tax implications of hiring remote employees or of remote work. Why would they, when it was not needed? But this lack of preparation has caught us off-guard.

Taxes and out-of-state employers

Come tax season and businesses and employers have realized that there are new tax rules they need to consider. Many employees moved away from their office location and to their hometowns, often in a different State. Now with different tax regulations for federal, state, and local taxes, the computation is a headache.

If you have an employee working in a different state than where you normally conduct your business, your tax obligation is based on the idea of whether you are ‘doing business’ in that state. The tax laws for this are different for different states. In some, just having an employee in their state can be considered an act of ‘doing business’ and you would have to follow the tax rules of that state as well.

Generally ‘doing business’ in a state is defined by the idea that the business is liable to a state’s income tax regulations, and is applicable to the sales it is making while operating in that state.

There has been some relief announced stating that employers with a remote workforce mandated by the pandemic are exempt from such tax laws. But this is only temporary. Sooner or later, the compliance needs will kick in.

Remote work is going to be a part of how we work from now on, even after the pandemic. Considering this fact, the tax implications and compliance regulations are a looming hurdle, waiting to happen.

If you have a remote workforce that resides in different states, you may find yourself facing unexpected tax burdens. This would mean you would need to evaluate every state’s policy on taxes and determine what your tax implications and liabilities are for each state.

If meeting the tax regulations takes away a part of your productive time when are going to work on growing your business?

Employee or independent contractor?

The fundamental difference between the two roles is clear, but the tax and compliance regulations are complex. If you list someone as an independent contractor, then the tax rules are different. And by that, we mean relatively easier. You just pay the contractor and they worry about how to file taxes on it, not you.

Does that mean you can list your employees as independent contractors? Absolutely not! Not only is that illegal, but you would also get into a lot of trouble from the tax authorities for misrepresenting your tax status.

Is there a solution to this?

Let’s break down the problem. If you have employees on your payroll who work remotely, you have to consider their resident status for tax purposes. And there can be multiple scenarios of an employee working remotely:

- An employee working remotely in the state where your business operates and is taxable at

- An employee working remotely in a state different from the one you operate in i.e. out-of-state remote employee

- If your employee lives in a state that follows the Multi-state taxation law

- If your business operates in a state that follows the ‘convenience of the employer’ rules (where the employee is liable to pay tax in the state your business is in, not the one they reside in)

It’s not a lie to say that it’s a nerve-wracking exercise to figure out taxes based on each of your employees’ resident status.

If you hire only independent contractors or freelancers, then you get away with the tax implications. But what about the trust and accountability of work? How can you ensure that you get your money’s worth? In all probability, you can’t. You can try, but it is quite impossible to build and grow a business without an accountable workforce.

Welcome to being stuck between a rock and a hard place.

Enter, the remote employee marketplace

Platforms offering access to top freelancers are many. Upwork, Fiverr, Freelancer, etc. are excellent platforms for that. But not if you are looking to build scalable teams.

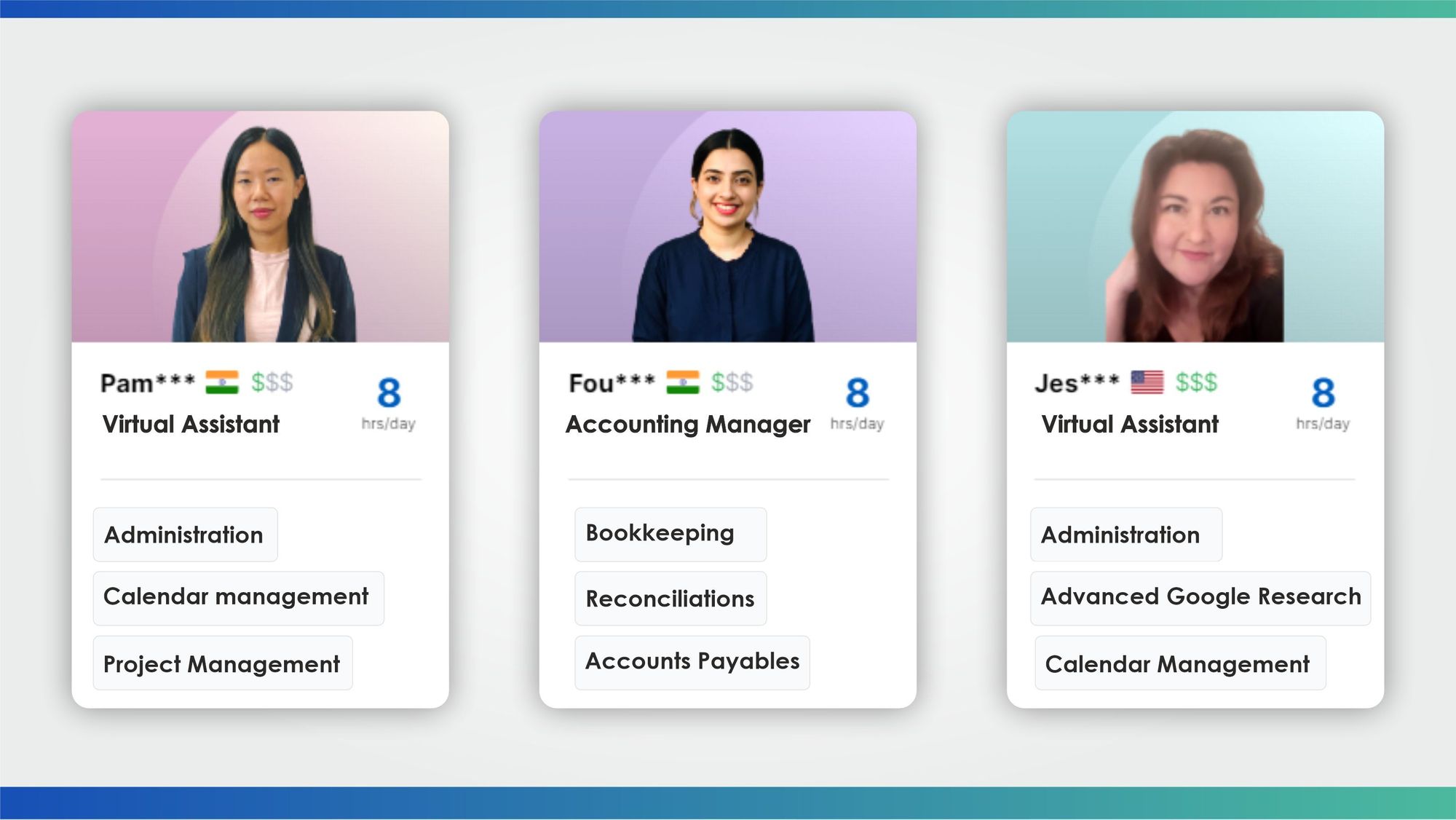

A remote employee marketplace like Wishup offers you fully managed remote employees. This means you don’t have to worry about things like:

- Talent search

- Onboarding

- Training

- Payroll

- Benefits

- Performance reviews

Wishup takes care of it all for you. We have some of the best remote talent you can use for your fast-growing business. Since they are onboarded on Wishup’s payroll, you don’t have to worry about employee taxes, ever. Like other talent marketplaces, you can choose who you want to work for you. But unlike other such marketplaces, you also can rest assured that the work will get done and there is in-built accountability in the process.

The remote employee you were assigned not meeting your expectations? No worries, we’ll switch it up and get a suitable replacement within a couple of days for you.

You pay a subscription fee to Wishup, similar to how you pay for any of the different software tools you might use like a CRM or a project management tool.

With Wishup, you get the trust and accountability of an employee with the tax freedom of an independent contractor. What are you waiting for then?