Templates for Bookkeeping: The Ultimate Guide for 2025

Want to take control of your finances in 2024? Discover how bookkeeping templates can transform your business! Simplify your financial record-keeping, track your expenses, and easily make informed decisions. Read to learn more.

Let's talk shop - bookkeeping and accounting are the backbone of any business.

Trying to run things without them, even for a week? It's like driving blindfolded.

But if we’re being honest, bookkeeping can be a real headache. Tracking, recording, analyzing—it can chew up much of your day, especially if numbers aren't your thing.

That's why you should make the most of templates. Templates save time and reduce errors, keeping your finances on track without the fuss.

In this blog, we'll break down why templates are game-changers and highlight the ones worth checking out.

So, are you ready to handle your finances like a pro? Let’s get started.

What Are Templates for Bookkeeping?

In the simplest terms, bookkeeping templates are pre-designed documents that come in various forms, like spreadsheets, forms, and digital documents. They can be used repeatedly with only minor adjustments to suit the particular needs of a business.

With the help of a bookkeeping template, businesses can easily record financial transactions and track their financial activities without spending a lot of time or effort.

Why Use Templates for Bookkeeping?

It’s simple.

They're time-savers—no need to start from scratch. Just input your data and go.

Plus, they ensure accuracy by providing structured formats, minimizing errors, and keeping your finances on point.

Types of Templates for Bookkeeping

1. Income Statement Template

Income statement templates are helpful for business owners to monitor their revenue, expenses, and overall profitability over a period.

When to use: Businesses can use these templates to record details on sales, cost of goods sold, operating expenses, and taxes.

How it helps: It helps them get a complete picture of the company's revenue, expenses, and net income. By clearly viewing their financials, business owners can make informed decisions about their finances.

Get the income statement template here.

2. Balance Sheet Template

Take control of your financial standing with our Balance Sheet Template. Essential for businesses seeking to assess their financial health at any given moment.

When to use: Employ this template to list assets, liabilities, and equity, providing a snapshot of your financial well-being.

How it helps: Easily monitor your assets and liabilities, enabling better financial management and decision-making for your business. Looking to enhance your financial management? Get templates free to simplify the process and maintain clear, accurate records.

Get the balance sheet template here.

3. Cash Flow Statement Template

A Cash Flow Statement is your go-to tool for managing cash flow effectively. It simplifies tracking cash movements and facilitates planning for upcoming expenses.

When to use: Employ this template to monitor incoming and outgoing cash flows over a specific timeframe.

How it helps: This template helps businesses gain insight into their cash position, mitigate cash shortages, and enhance financial planning. With it, businesses can effectively manage their finances and make informed decisions.

Get the cash flow statement template here.

4. Managerial Accounting Template

Managerial accounting templates allow business owners to track and analyze financial data and make informed decisions.

When to use: These templates provide a comprehensive view of a company's financial performance. They include sections for revenue, expenses, profits, and losses.

How it helps: Businesses can use these templates to record these transactions and gain deeper insights into their operations. They can also pinpoint areas for improvement and make sound decisions.

Get the managerial accounting template here.

5. Cost Accounting Template

Cost accounting templates can be powerful tools for businesses. They help you monitor the expenses involved in producing a product or service.

When to use: These templates usually consider direct costs, such as labor and materials, and indirect costs, like overhead and administrative expenses.

How it helps: Using cost accounting templates, businesses can effectively manage their costs and identify areas to reduce their expenditure.

Get the cost accounting template here.

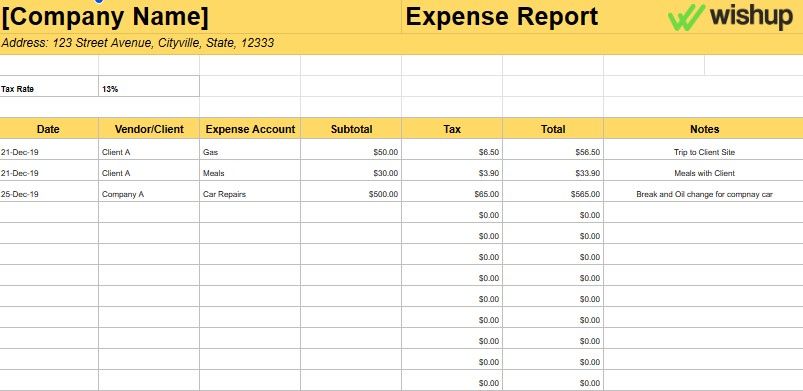

6. Expense Form Template

Designed for businesses, this template streamlines the process of recording expenditures and ensures accurate financial documentation.

When to use: To systematically record and track their expenses, ensuring accurate financial records and compliance with budgetary guidelines.

How it helps: It simplifies expense tracking, facilitating timely and organized documentation of expenditures. It enables businesses to analyze spending patterns, identify cost-saving opportunities, and make informed financial decisions.

Get the expense report template here.

7. Sales Invoice Template

Sales invoice templates provide businesses with a convenient way to bill customers for products or services sold.

These invoice templates typically include the date of the sale, the product or service sold, the price, and any applicable taxes. Sales invoice templates help businesses easily manage their accounts receivable and ensure prompt payment for their goods or services.

When to use: Use this template for every sale to quickly create detailed invoices.

How it helps: This template simplifies invoicing, ensures accurate documentation, and speeds up payment collection, enhancing businesses' cash flow management.

Get the sales invoice template here.

8. Statement of Account Template

The Statement of Account Template provides businesses with a structured format for presenting detailed information regarding their financial transactions with customers or clients.

When to use: Employ this template to compile and communicate a summary of transactions, including invoices, payments, and balances owed, to customers or clients.

How it helps: By utilizing this template, businesses can maintain transparent and accurate records of financial interactions, facilitate communication with customers regarding their account status, and ensure timely payment collection, ultimately enhancing financial management and customer relations.

Get the statement of account template here.

9. Accounts Payable Ledger Template

The Accounts Payable Ledger Template is a comprehensive tool designed to help businesses track and manage their accounts payable effectively.

When to use: Use this template to record all outstanding invoices, track payments, and monitor the amounts owed to suppliers or vendors.

How it helps: This template allows businesses to maintain organized records of their payables, track payment due dates, avoid missed payments or late fees, and ensure timely and accurate financial reporting.

Get the accounts payable template here.

10. Accounts Receivable Template

With the help of accounts receivable templates, business owners can track customer invoices and payments effectively.

When to use: Record sales transactions, track outstanding invoices, and monitor payments received from customers.

How it helps: This template can help businesses streamline their accounts receivable process, improve cash flow management, reduce overdue payments, and maintain clear and accurate records of customer transactions for better financial visibility.

Get the accounts receivable template here.

Best Resources for Templates for Bookkeeping

Now that you know the different types of bookkeeping templates, you might be interested in knowing where can you get these templates, right?

Well, numerous resources offer top-notch bookkeeping templates for different businesses. Let's have a look at the most popular ones:

Smartsheet: A comprehensive platform offering top-notch bookkeeping and accounting Excel templates. Templates cover income statements, balance sheets, cash flow statements, and expense tracking. Fully customizable and compatible with bookkeeping software.

Business Accounting Basics: This site provides 16 free Excel accounting templates, including cash books, balance sheets, and more, catering to basic bookkeeping needs.

ExcelDataPro: Offers various Excel templates for managing invoices, employee salaries, balance sheets, and more, along with additional resources like FAQs and blogs.

Beginner Bookkeeping: Specifically designed for beginners and small business owners, offering easy-to-understand accounting templates in Excel. Templates cover cash flow forms, balance sheets, and more, with clear explanations provided for usage.

Boost Your Productivity by Outsourcing

Using an accounting spreadsheet or bookkeeping Excel template is an excellent way to simplify your financial recordings and management. However, you will still need to spend plenty of time filling out these templates, analyzing the statements, and ensuring everything is up-to-date and accurate.

As a business owner, finding time for all this can be difficult. So, to boost your productivity, you should consider hiring a virtual bookkeeping assistant or outsourcing your routine bookkeeping tasks.

Here are some of the ways in which outsourcing bookkeeping and accounting services can help you boost your productivity and gain a competitive advantage:

1. Time Savings

Outsourcing bookkeeping services can be an excellent way for businesses to maximize their efficiency and productivity. It allows you to free up your employees' time, enabling them to focus on their core competencies. Moreover, outsourcing providers have the expertise and experience to complete the bookkeeping quickly and accurately, allowing businesses to maximize their time and resources.

2. Increased Accuracy

For the financial well-being of any business, accurate bookkeeping is a necessity. Unfortunately, you may find it difficult if you don't possess the relevant training and experience.

To guarantee that your business's financial documents are correct and current, you can opt for online bookkeeping service provider. Virtual bookkeepers have all the tools, skills, and knowledge they can use to ensure all financial information is recorded correctly, thus minimizing potential errors.

3. Reduced Costs

Businesses can benefit from cost savings by outsourcing their bookkeeping tasks. Having an in-house hire a bookkeeper may be expensive due to the need to cover salary, benefits, and training. However, outsourcing providers offer these services at a more economical rate without needing to pay for any employee-related expenses.

Simplify, Streamline, Succeed

We hope you've found the perfect template to streamline your financial processes and propel your business to new heights.

Whether you're tracking expenses, managing invoices, or assessing your financial standing, these templates offer invaluable assistance.

Outsourcing bookkeeping duties to a professional provider can offer numerous advantages, such as time savings, greater precision, and cost reduction. So, don't wait for long. Schedule a free consultation with us at Wishup or email us at [email protected]

Bookkeeping Template: Frequently Asked Questions

- What is a template in accounting?

A template in accounting is a pre-designed format for recording financial transactions, including income, expenses, assets, and liabilities. It provides a structured framework for accurate and efficient bookkeeping. - Does Excel have a bookkeeping template?

Yes, Excel offers various bookkeeping templates designed to assist with tasks such as income and expense tracking, balance sheets, cash flow statements, and general ledger management. - Does Google Sheets have a bookkeeping template?

Yes, Google Sheets provides bookkeeping templates similar to Excel, offering functionalities for income and expense tracking, balance sheets, cash flow statements, and general ledger management, accessible online and collaboratively. - How to do simple bookkeeping?

Step 1: Organize financial documents.

Step 2: Create accounts for income and expenses.

Step 3: Record transactions accurately.

Step 4: Reconcile accounts regularly.

Step 5: Generate financial reports.

Step 6: Analyze financial performance.

Step 7: Adjust records as needed.