Master Expense Recording In Bookkeeping Seamlessly

Effective bookkeeping is crucial for the success of any business. In this guide, we will provide an overview of recording expenses in bookkeeping and provide practical tips for entrepreneurs to maintain accurate financial records.

Unlocking the door to financial success requires more than just tallying up sales figures. In the complex dance of business, every step, every expense, and every dollar counts.

While the excitement of chasing sales and revenue is understandable, overlooking the meticulous tracking of expenses can lead to serious consequences. In the hustle and bustle of running a business, it's easy for expenses to slip through the cracks, leading to inaccuracies in financial records.

This not only hampers the ability to make informed decisions but also puts the business at risk of financial instability and compliance issues.

Entrepreneurs who recognize the importance of maintaining accurate financial records understand that it's not just about compliance; it's about gaining insights that drive growth and sustainability.

In this guide, we'll outline expense recording in bookkeeping and offer practical tips for entrepreneurs to maintain precise financial records. Whether you're a seasoned entrepreneur or just starting out, this guide will equip you with the tools and insights to navigate bookkeeping confidently.

Bookkeeping's Expense Secrets: What Lies Behind the Ledger?

When you are running a business, there are many things for which you spend money. All these are referred to as expenses. An expense is a cost involved in running a business so that you can earn revenue. Some of the examples of expenses a business incurs include:

- Building rent.

- Utility bills, including electricity, water, telephone, and internet.

- Purchase of equipment and maintenance.

- Marketing and advertising costs.

- Cost of transportation.

- Salaries, wages, commissions, incentives, and related costs.

- Merchant and bank fees.

- Shipping expenses.

The Various Facets of Business Expenses

The business expenses you incur while operating your business can be classified under different heads or categories. You must categorize the expenses so they are correctly recorded. The information below will help you understand more about expense types and make it easy to record expenses.

Operating and Non-Operating Expenses

When expenses are classified, you can categorize them as operating or non-operating. Operating expenses are the costs incurred selling goods and services. Examples of operating expenses are rent, salaries, and marketing costs. It also includes general costs needed to run the business, such as research, travel, and IT expenses.

Non-operating expenses cannot be specifically linked to revenue from operations. For example, interest payment to the bank is unrelated to income. Similarly, inventory write-off is a non-operating expense.

Fixed and Variable Expenses

As the name itself suggests, fixed expenses do not change in value. The amount you need to spend remains the same for a particular period. For example, rent paid would usually be fixed for a year or more. Similarly, salaries are unlikely to change for at least a year or six months. These are fixed expenses whose value will not change.

Variable expenses are those whose value can change at any time. For example, the electricity bill depends on how much power you consume. It can vary depending on the season. E.g., using more heating during winter.

Financial Expenses

Businesses would need to borrow from lenders and creditors. Expenses related to this are termed financial expenses. Examples include interest on long-term or short-term loans, fees for loan origination, and other borrowing-related costs such as loan processing fees or commitment fees.

Accrued Expenses

When you incur an expense but have not yet paid, it is termed accrued expense. For example, wages are incurred as work is done. But the payment is done at the end of the month.

Deductible and Non-Deductible Expenses

Deducting certain expenses from your gross income while calculating taxes is possible. Such expenses are called deductible expenses. All other expenses you cannot deduct are known as non-deductible. Deductible accounting expenses examples include travel expenses, advertising costs, insurance, office expenses, and utilities.

Non-Cash Expenses

Expenses not paid for in cash directly are termed non-cash expenses. Example: Depreciation.

Prepaid Expenses

When you pay for an expense in advance, it is known as a prepaid expense. If you pay your rent in advance, it would be considered a prepaid expense.

Expenses vs. Expenditure

Expenses are the costs incurred to get something of value. It is the amount you spend on goods and services. You incur expenses to run your business. The key concept involved here is that expenses help earn revenue for your company. E.g., You spend on advertising to increase sales.

Expenditure is an amount spent to purchase an asset or a service. It is classified either as capital or revenue expenditure. Capital expenditure is money paid to acquire assets (e.g., buying equipment). Revenue expenditure helps to fund business operations (e.g.: funds for research).

Expenses vs. Costs

A cost is an investment made to purchase an asset for the company. An expense is a regular payment made to help the business generate money. The purpose of a cost is to acquire an asset, while expenses help earn revenue. Expenses have a direct impact on profitability, while costs do not have a direct impact on profitability.

Costs are one-time payments, whereas expenses are recurring in nature. For example, buying machinery is a one-time activity, whereas paying building rent happens every month. Costs are shown in the balance sheet, while expenses are shown in the profit and loss statement.

Your Step-by-Step Guide for Expense Recording

To record your expenses, you need to follow a systematic procedure. The steps involved in recording expenses answer your question on how to record expenses.

Step 1: Keep them separate from your expenses.

The expenses you spend for your business differ from those incurred for your personal needs. Mixing up business and personal expenses is a bad practice and must be avoided. Separate your business expenses from personal expenses.

Consider this scenario: Jane, a small business owner, used her personal credit card to pay for both business and personal expenses. When tax season rolled around, she faced a tangled mess of receipts and transactions, making it difficult to determine which expenses were deductible.

Don't let this happen to you. Take the time to establish clear boundaries between your business and personal finances to avoid headaches down the line.

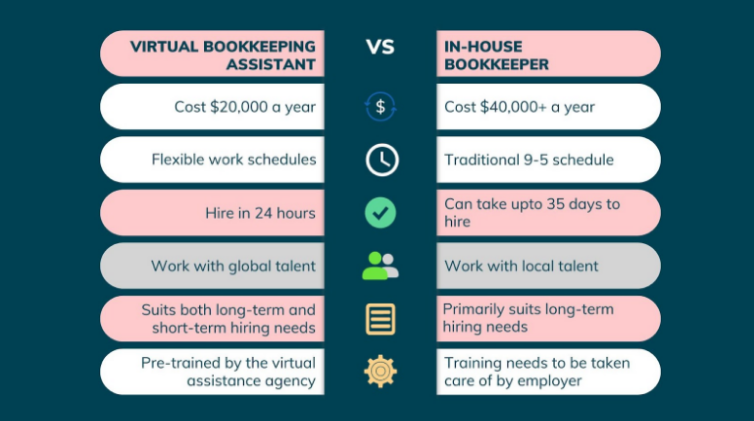

Step 2: Choose who will keep track of expenses and how.

It is crucial to decide who will do the work. You need a bookkeeper to track your expenses. You could do it yourself, meaning you have to devote a lot of time to this work daily. Using a software tool is an option, but you still need to record expenses in the software. You could also hire a bookkeeper or virtual assistant to complete your work.

Consider this scenario: Take the example of Mark, a busy entrepreneur running a growing tech startup. Initially, he attempted to manage expense tracking himself but quickly found it consuming too much valuable time. Instead, he opted to hire a bookkeeper to handle this task, allowing him to focus on strategic business initiatives while ensuring accurate expense records.

Step 3: Select accounting and bookkeeping procedures

There are different ways of bookkeeping. You could use either the single or double-entry system. In a single entry, you would record transactions only once. In the double entry, you would record all transactions as debit or credit. It is the most common system followed. The other option is to record using an accrual basis, where you record expenses when it is billed. You can also choose the cash option, where you record expenses after making a payment. Many entrepreneurs find it helpful to use an Excel bookkeeping template to simplify these processes, making it easier to track and categorize their expenses effectively.

For Example: Sarah, a freelance graphic designer, opted for the double-entry system to ensure accuracy and compliance with tax regulations. This method required recording each transaction as a debit or credit, providing a comprehensive view of her financial health.

Meanwhile, Mike, a small business owner in the retail sector, preferred the cash basis for its simplicity, recording expenses only after payment. Both approaches have their merits—it's essential to choose the one that aligns best with your business needs.

Step 4: Be sure to classify them correctly.

Expenses have to be appropriately classified or categorized. It will help you analyze your expenses. Most importantly, it would be helpful when you claim tax deductions.

For Instance: Take John, who runs a landscaping business. By categorizing expenses such as equipment purchases and fuel costs appropriately, he gains valuable insights into his operational costs and can identify areas for potential savings or optimization. For example, by tracking fuel costs, John can pinpoint inefficiencies in his routes or equipment maintenance, ultimately boosting his bottom line.

Step 5: Save your receipts.

Save receipts for payments, as the IRS requires you to keep records for three years. Saving receipts may seem like a mundane task, but it's critical for tax compliance.

For Example: Consider the case of Emily, a freelance writer who diligently saves all receipts related to her business expenses. When audited by the IRS, she was able to provide documentation for every deduction claimed, avoiding potential penalties or fines. This meticulous record-keeping not only ensured Emily's financial security but also gave her peace of mind knowing she had solid proof of her business expenses.

Step 6: Balance your bank accounts and expenses

Reconcile the expenses you have recorded by tallying them with your bank account. It ensures you can spot any errors and rectify them.

Consider this: Regularly reconciling bank accounts with recorded expenses is another vital practice. For David, a small business owner in the hospitality industry, this process revealed discrepancies between his records and bank statements, prompting further investigation into potential errors or fraudulent activity. By staying vigilant and conducting regular reconciliations, David was able to detect and address issues promptly, safeguarding his business's financial integrity and ensuring peace of mind for himself and his stakeholders.

Step 6: Ensure you don't overlook any typical small business expenses.

You have to record every single expense incurred. If you buy a pen, you may not feel it is important to record it. But it is an expense for your business and must be recorded to help you claim deductions later.

For Instance: Meet Jonah, a boutique bakery owner. In the midst of her busy days, she often overlooked small expenses like purchasing baking supplies or office supplies like pens. But come tax time, she realized the importance of tracking every expense, no matter how small. With the help of her accountant, she learned that even seemingly minor purchases could be claimed as legitimate business expenses, maximizing her deductions and giving her a clearer financial picture. Remember, every penny counts in business.

Why Expense Recording is key for Business Success?

A question likely to arise in your mind is the importance of expense accounting. What would happen if you miss out on recording business expenses? The reasons you need to record expenses are listed below to answer your question:

- It helps you control your cash flow better.

- When you start recording all your expenses, you can track whether you are within budget.

- It helps you claim deductions while filing taxes.

- You can know how profitable your business is.

Essential Guidelines for Financial Precision

- Identify the object to connect to a specific cost.

- You can accumulate all the costs related to the selected cost object. It is known as a cost pool.

- Decide the method to allocate costs. Depending on your business needs, you could choose proportional or activity-based allocation.

- Carry out the calculation as per the method chosen.

- Evaluate your method periodically and make adjustments if needed.

The Power of a Bookkeeper for Expense Recording

A virtual bookkeeping assistant does not sit in your office but works remotely. The benefit is that you don’t have to set aside space in your premises and allot resources. The charges you pay depend on the work you have. As a result, you will be spending much less when compared to hiring a full-time bookkeeper.

A remote bookkeeper can help you with all your bookkeeping work and ensure an up-to-date book of accounts. It helps you ensure that financial reports are accurate and no key activity is missed. Most importantly, you can focus on your core work of growing your business.

Streamline Finances with Wishup's Remote Bookkeeping Services

While often underestimated, mastering expense recording can streamline your operations and finances.

But fear not, navigating this terrain is made easy with Wishup's virtual bookkeeping services.

Our focus on quality guarantees optimal results, allowing you to focus on what truly matters – growing your business. Schedule a free consultation today to discover how we can tailor our services to meet your specific needs. Streamline your processes and empower your business with Wishup.

What other things would entrepreneurs want to know?

What are the 4 types of expenses?

The four key types of expenses are:

- Fixed and variable expenses.

- Operating and non-operating expenses.

- Deductible and non-deductible expenses.

- Financial and non-cash expenses

Why do we record expenses?

When you record all the expenses incurred, you are ensuring you get a complete picture of your finances. It would help you understand how you are spending money. Most importantly, it helps you understand your profitability.

Where are expenses recorded in accounting?

The details of all expenses are recorded in the expense account in your income statement.