The global virtual assistant market has moved past experimentation. Business owners and busy high-level executives are deciding how to integrate virtual assistants into everyday operations.

This report, compiled by Wishup, breaks down what’s actually happening in the global virtual assistant market right now. It was compiled based on real hiring data, workforce trends, and long-term signals (not hype or short-term spikes).

You’ll see where growth is coming from, why adoption is holding steady, and what these shifts mean for businesses planning their operations through 2026 and beyond.

How Was This Global Virtual Assistant Market Report 2026 Developed?

This report was built to answer one core question:

What is actually happening in the global virtual assistant market, and what is likely to happen next in 2026?

To do that, we combined multiple data sources, tracked trends over time, and focused on signals that show durability, not short-term spikes.

Here’s how the report came together.

Data Sources Used:

The findings in this report are based on a combination of primary and secondary data, including:

- Global surveys covering remote work adoption, outsourcing behavior, and operational roles

- 1259 Internal surveys covering Wishup’s longstanding clientele’s virtual assistant outsourcing behaviour

- Hiring platform data tracking remote job postings, role demand, and skill requirements

- Labor market data related to hybrid work, workforce participation, and talent availability

- External industry and market reports on outsourcing, AI adoption, and global services growth

Note: Each source was used to validate the others. No single dataset was taken at face value.

15 Key Virtual Assistant Market Stats (2025–2026)

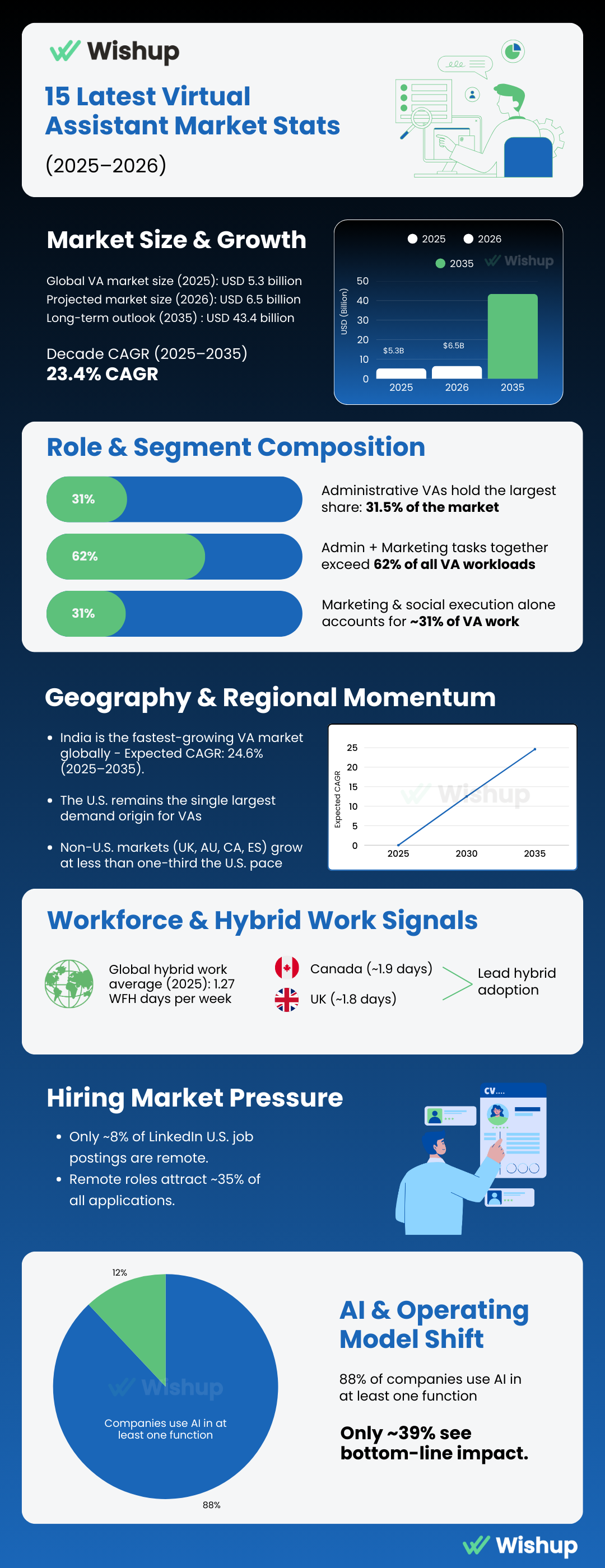

Stats on virtual assistant market size & growth

- Global VA market size (2025): USD 5.3 billion. The virtual assistant services market has moved firmly into mainstream adoption.

- Projected market size (2026): USD 6.5 billion. Reflects continued short-term acceleration, not speculative long-range forecasts.

- Long-term outlook (2035): USD 43.4 billion. Indicates a structural, decade-long expansion rather than a cyclical trend.

- Decade CAGR (2025–2035): 23.4%. One of the fastest growth rates across service-based remote work industries.

Stats on VA role & segment composition

- Administrative VAs hold the largest share: 31.5% of the market. Internal coordination, inbox management, calendar scheduling, and documentation work still dominate demand.

- Admin + Marketing tasks together exceed 62% of all virtual assistant workloads. Shows where businesses feel the most operational pressure today.

- Marketing & social execution alone accounts for ~31% of VA work. Digital visibility has become a core operational function, not a side task.

Stats on the geography of virtual assistants

- India is the fastest-growing VA market globally. Expected CAGR: 24.6% (2025–2035).

- The U.S. remains the single largest demand origin for VAs. It is driven by SMB density, hybrid work maturity, and outsourcing familiarity.

- Non-U.S. markets (UK, AU, CA, ES) grow at less than one-third the U.S. pace. Signals a strong interest, but slower adoption velocity.

Stats on the VA workforce & hybrid work signals

- Global hybrid work average (2025): 1.27 WFH days per week. Indicates stabilization, not decline.

- Canada (~1.9 days) and the UK (~1.8 days) lead hybrid adoption. Confirms hybrid work as a permanent operating model in developed markets.

Stats on hiring market pressure

- Only ~8% of LinkedIn U.S. job postings are remote. Yet demand far exceeds availability.

- Those remote roles attract ~35% of all applications. It is an indication of a clear supply-demand mismatch in the labor market.

Stats on AI & operating model shift

- 88% of companies use AI (as in software/apps/tools) in at least one function. However, only ~39% see bottom-line impact. This reinforces why human operators (including virtual assistants) are needed to translate AI into execution.

What Does the Data Reveal Next? (Inside the Full Report)

Inside the full report, we unpack questions most leaders are actively wrestling with in 2025–26:

- Which industries are scaling VA usage fastest? Why some sectors retain VAs longer than others?

(The retention patterns are not evenly distributed.) - How are SMBs and enterprises using VAs differently as AI adoption increases? (The workflows diverge more than expected.)

- Which tools VAs are trusted with most, and which platforms founders hesitate to delegate?

(This reveals where operational trust is truly shifting.) - What engagement models (full-time vs half-day vs part-time) are actually working in practice?

(The numbers challenge common assumptions.) - Where AI is genuinely increasing VA productivity, and where it’s adding friction instead of leverage?

(Adoption does not equal efficiency.) - Which regions are becoming talent bottlenecks, and which still offer long-term supply stability?

(This has direct cost and hiring implications.)

👉 Download the full Global Virtual Assistant Market Report (2025–2026) to access the complete data, detailed breakdowns, and forward-looking insights.

Virtual Assistant Market 2026 Overview

The global virtual assistant (VA) market is expanding at scale, supported by long-term shifts in how businesses hire, operate, and manage distributed teams.

Here are the key numbers that define the market heading into 2025–2026.

Current Market Size:

In 2025, the global virtual assistant services market is valued at USD 5.3 billion.

This includes:

- Administrative virtual assistants

- Virtual executive assistants

- Automation expert VAs

- Managed and agency-based VA services

Among all categories, administrative virtual assistants hold the largest share, accounting for 31.5% of the market. This reflects continued demand for calendar management, operations support, documentation, and cross-team coordination.

Growth Rate and Expansion Trajectory

The market is on a steep long-term growth curve.

- By 2026, the market is projected to reach USD 6.5 billion

- By 2035, it is expected to scale to USD 43.4 billion

This represents a decade-long CAGR of 23.4%, placing virtual assistant services among the fastest-growing segments within the global remote services economy.

Growth is not driven by experimentation. It is driven by sustained business reliance on virtual human talent.

Share of Remote-Enabled Roles

Virtual assistants sit squarely within the broader normalization of remote and hybrid work.

As of 2025:

- The global average stands at 1.27 work-from-home days per week

- Countries like Canada (~1.9 days) and the UK (~1.8 days) lead adoption

This stable hybrid rhythm has made remote operational roles permanent rather than temporary. Virtual assistants now operate as part of everyday business infrastructure, supporting distributed teams across time zones.

SMB vs Enterprise Contribution (High-Level)

Market demand is led primarily by small and mid-sized businesses (SMBs).

- SMBs adopt VAs faster due to speed, flexibility, and cost efficiency

- Enterprises contribute a growing share, often through managed or hybrid service models

India stands out as the fastest-growing regional market, with an expected 24.6% CAGR (2025–2035). This growth is driven by a large, skilled workforce, competitive economics, and rapid SME digitization.

What These Numbers Signal: The Virtual Assistant Market Trend

Together, these numbers capture the top trends in the virtual assistant market. VAs now function as a core, scalable workforce rather than a temporary cost play.

Download the Full 2026 Virtual Assistant Market Report

This report goes deeper than public market data. It covers usage patterns, retention signals, and real adoption behavior. Download the full report to access insights that you cannot find elsewhere.

Author - Neelesh Rangwani · Co-founder at Wishup

With 10+ years in the virtual assistant space, Neelesh has helped 1000+ US and global founders build efficient remote teams by matching them with top 0.1% virtual assistant talent. He writes about virtual assistants, hiring frameworks, remote productivity, and scaling ops.

More posts by Neelesh → · Connect on LinkedIn