Looking for an alternative to Pilot Bookkeeping?

Wishup’s certified virtual bookkeepers will help you take control of your business's finances.

Wishup simplifies everything from bookkeeping and monthly bank reconciliation to expense tracking, invoicing, and more for enterprises, small businesses, startups, personal finance, photographers, cleaning businesses, therapists, etc.

Name the industry, and we have certified bookkeepers ready to manage your books and financial statements.

What is Wishup’s Bookkeeping Service?

Wishup provides you with triple-vetted, certified bookkeepers who are experts at delivering transparent and 100% accurate GAAP, IFRS, or whichever system you follow, compliant financial information.

Our virtual bookkeeping-backed team takes responsibility for setting up your account, managing accounts payable and receivable, and generating monthly and annual financial reports.

With a bench of over 500 virtual bookkeepers, our team combines breadth and depth of experience, each professional bringing at least three years of hands-on expertise in U.S. bookkeeping standards and state-specific regulations, with many offering over a decade of trusted financial stewardship for American businesses.

Besides a dedicated virtual bookkeeper, you get an account manager and a bookkeeper manager who cross-verifies your books and financial statements.

We also offer a choice of three subscription pricing levels for our managed and dedicated bookkeeping services.

Need fractional accounting or CPA services. Wishup has your back.

Wishup Bookkeeping and Tax Service: Simple Options for Your Business

At Wishup, we offer full-service accounting and bookkeeping support. You can choose from three easy options depending on what your business needs. Here’s a quick look:

1. Managed Bookkeeping Services

Don’t want to hire a full-time bookkeeper? Our managed bookkeeping is a great fit for solo business owners and startups.

- We take care of your bookkeeping.

- Prices start at just $300.

- You get expert help without hiring a dedicated bookkeeper for your business.

2. Dedicated Virtual Bookkeeper

Need more hands-on help? Get your own dedicated virtual bookkeeper who works like part of your team.

- Perfect for businesses with regular income, payroll, and vendors.

- Choose how many hours per month: 40, 80, or 160 hours

- Your bookkeeper handles all your daily financial tasks.

- Prices start at $699, $999, and $1799 per month

3. Switch Anytime

Start with Managed Bookkeeping and switch to a Dedicated Bookkeeper anytime, no extra steps or stress. Simply inform your account manager and get your services upgraded.

Hear from Aaron Mannan, acclaimed business coach, about his experience with the standards of WISHUP'S BOOKKEEPING SERVICE. Don’t miss his story!

Tax Preparation

In addition to managing your books, we provide expert support for federal and state income tax filings(including 1040, 1065, 1120, 1120s ), 1099s, W2, W9, and Franchise tax filings.

What is Pilot Bookkeeping?

Pilot bookkeeping includes CFO and tax services designed for startups and small businesses. They have a team of 250+ US-based experts who help your business get on solid financial ground.

After signing up, Pilot pairs you with a dedicated bookkeeper who transfers your financial information to QuickBooks Online (QBO), their preferred software.

Pilot relies exclusively on QuickBooks Online for all its bookkeeping needs and uses accrual-basis accounting.

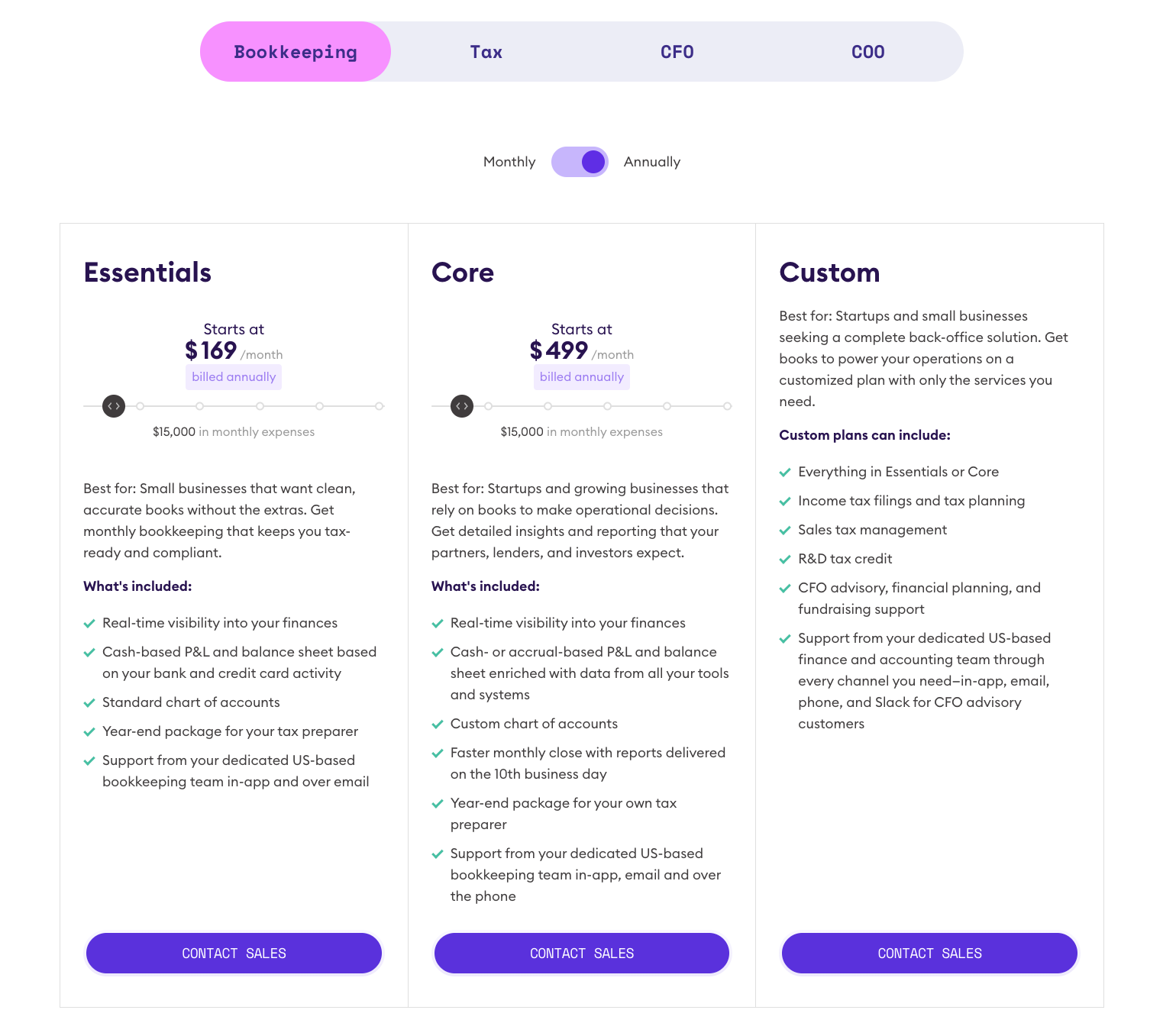

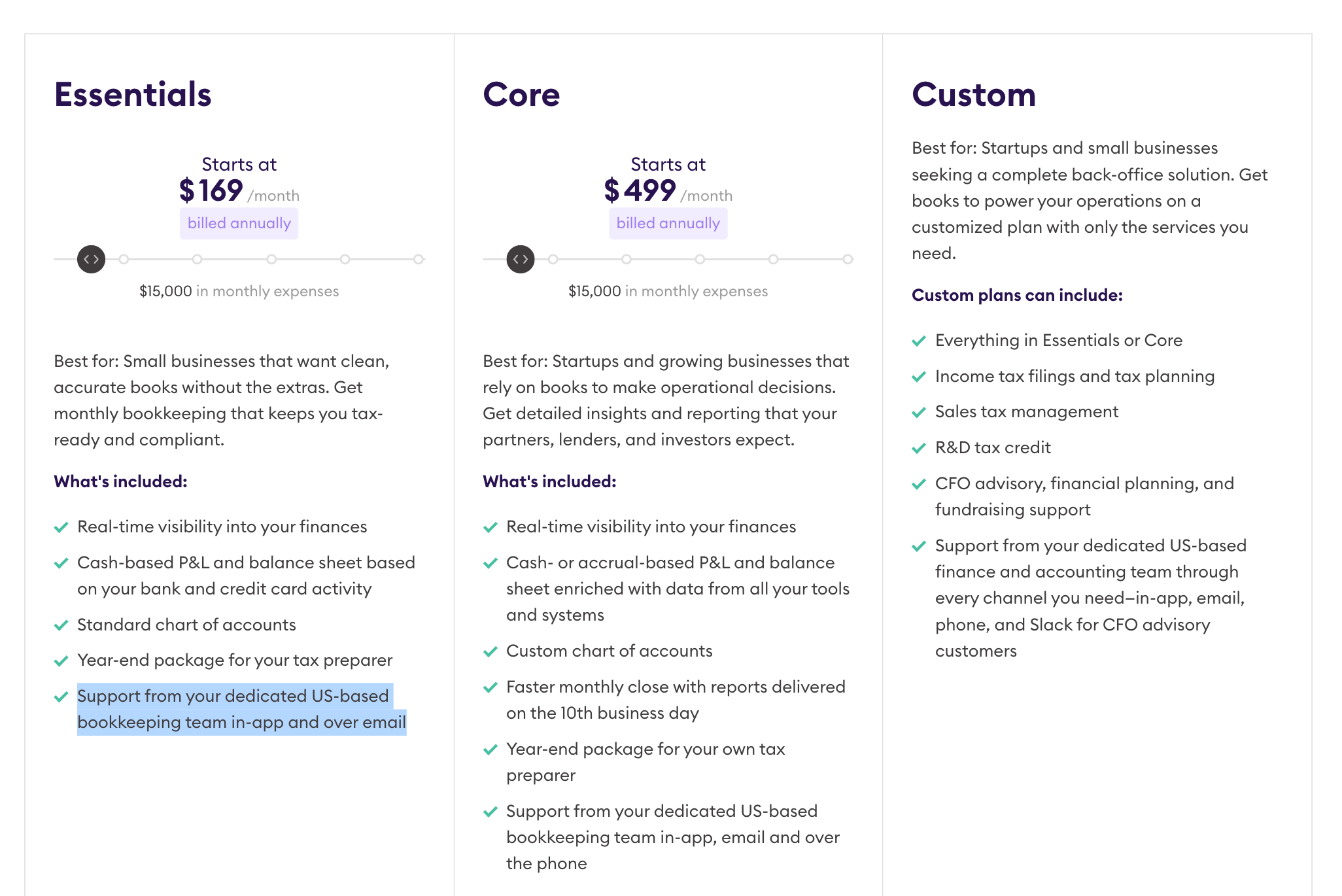

Now, if you plan to outsource bookkeeping services to Pilot, you'll get a choice of three distinct pricing plans, starting monthly and annually, based on your business's monthly expenses. We'll discuss Pilot's pricing in-depth in the later sections.

Onboarding Time:

Choosing a bookkeeping partner shouldn't delay your ability to run your business. Yet, for many, that’s exactly what happens with Pilot bookkeeping service.

60 Minutes with Wishup's Remote Bookkeeping Service

Wishup’s onboarding process is streamlined, efficient, and fully virtual. Within 60 minutes, you're matched with a certified virtual bookkeeper, onboarded onto your preferred tools, and your outsourced bookkeeping service begins.

You’ll see reconciled books, real-time updates, and clean financials by the end of the first week. Wishup’s process fits into your business flow, not the other way around.

Wishup offers an online bookkeeping service that’s fast, frictionless, and built around your urgency. With same-day activation, you avoid costly delays and keep your financials moving forward, unlike with Pilot’s drawn-out onboarding.

Software Compatibility

Your books are only as good as the system they’re built on, and Wishup doesn’t make you change yours.

Wishup Works with What You Already Use

Wishup supports 120+ accounting and productivity platforms, including QuickBooks, Zoho, Xero, Wave, and others. Whether you're a solopreneur managing vendors through Zoho or a growing ecommerce brand tracking orders in Shopify + Xero, Wishup plugs into your stack seamlessly.

Pilot - QuickBooks Online

Pilot only supports QuickBooks Online (QBO). If you're using any other accounting software, you’ll be required to migrate everything to QBO.

Wishup's flexibility makes it one of the best bookkeeping services for small businesses, especially those using modern tool stacks. You keep your workflow, your history, and your sanity.

Pricing Transparency and Value

Wishup’s Simple Pricing Lets You Scale Without Surprises

Wishup offers clear, flexible pricing with no annual contracts or fine-print surprises. You can start with managed bookkeeping services at just $300/month, or choose a dedicated virtual bookkeeper for $999 (80 hours) or $1799 (160 hours) per month.

These are month-to-month commitments, making it easier for startups and growing companies to adjust as their needs change.

You won’t need to calculate hidden onboarding fees, pay extra for “add-ons” like tax prep or AP/AR, or worry about annual lock-ins. For any founder managing cash flow, this kind of pricing predictability is critical.

Pilot Bookkeeping Pricing

Pilot bookkeeping service starts at $169/month, billed annually but only with an annual prepayment. It goes up to $5250 per month for growing companies needing CFOs.

Here’s the updated information on how Pilot's pricing works for each monthly bookkeeping subscription at the various ranges of monthly expenses when paid annually :

Bookkeeper Expertise: Strategic Support vs. Transaction Processors

Wishup Pairs You With Elite, Industry-Specific Professionals

Wishup employs only the top 0.1% of virtual bookkeepers, each vetted through a rigorous six-step process. These aren’t entry-level bookkeepers. They’re certified experts with 3–10+ years of experience in U.S. GAAP, IFRS, and bookkeeping for industries ranging from ecommerce and healthcare to nonprofits and real estate.

With Wishup, you get a professional bookkeeping service that actively supports your business goals, understands compliance, and anticipates financial blind spots before they become problems.

Expertise of Pilot Bookkeeper:

Pilot offers highly skilled bookkeepers and accountants with cutting-edge workflows that surpass traditional error-prone accounting approaches.

Support & Communication:

Good bookkeeping isn't just about numbers; it's about communication. When you have a question, you need an answer.

Wishup Gives You a Real Human Whenever You Need One

With Wishup, you're assigned not just a bookkeeper but also a dedicated financial partner, along with an account manager and a bookkeeper manager to ensure accuracy.

Need help?

You can reach them by phone, email, Slack, or video, whichever suits you. Whether you're clarifying a transaction, requesting a custom report, or adjusting cash flow planning, support is fast, friendly, and always available.

Pilot Bookkeeping Makes You Work Through a Portal, Not a Person

Pilot’s customer support is designed for scale. You get support from your dedicated US-based bookkeeping team in-app and over email.

With Wishup’s bookkeeping service online, you get fast, expert responses.

Conclusion: Outsource Your Bookkeeping Needs In 60 Minutes With Wishup

If you’re searching for bookkeeping outsourcing services, virtual bookkeeping services, or simply the best bookkeeping service for your business, Wishup is the answer.

Book a call today. Outsource your bookkeeping with confidence. Choose Wishup.

Disclaimer: This article represents the personal opinions of a guest contributor and does not reflect the official views of Wishup. While we strive for accuracy, company details, offerings and data present may change over time. Readers are encouraged to verify information independently. Wishup assumes no responsibility for its accuracy.