You’re probably here because Bookkeeper360 is on your radar, and for good reason. Let’s do a quick side-by-side comparison with Wishup across some key parameters to help you decide the best fit for your business.

Bookkeeper360 vs Wishup - Quick Comparison

| Bookkeeping Plan Features | Wishup | Bookkeeper360 |

|---|---|---|

🚀 Meet Wishup in 30 Seconds

- ✅ 10+ years in the industry

- ✅ 1,500+ founders served across 50+ industries

- ✅ 200+ skill areas, 70+ no-code tools, 50+ AI tools

- ✅ Clients from Harvard and Y Combinator-backed startups

- ✅ Onboards trained accountants in just 60 minutes

- ✅ 98.8% client satisfaction | 99% on-time delivery

- ✅ Top 0.1% talent only – pre-vetted & ready to start

- ✅ 6-step vetting process (aptitude, cognitive, English, and more)

- ✅ Flexible plans starting at $9.99/hr — no long-term contracts

- ✅ 7-day money-back guarantee

- ✅ Lifetime satisfaction guarantee

What's The Major Difference Between Wishup and Bookkeeper360?

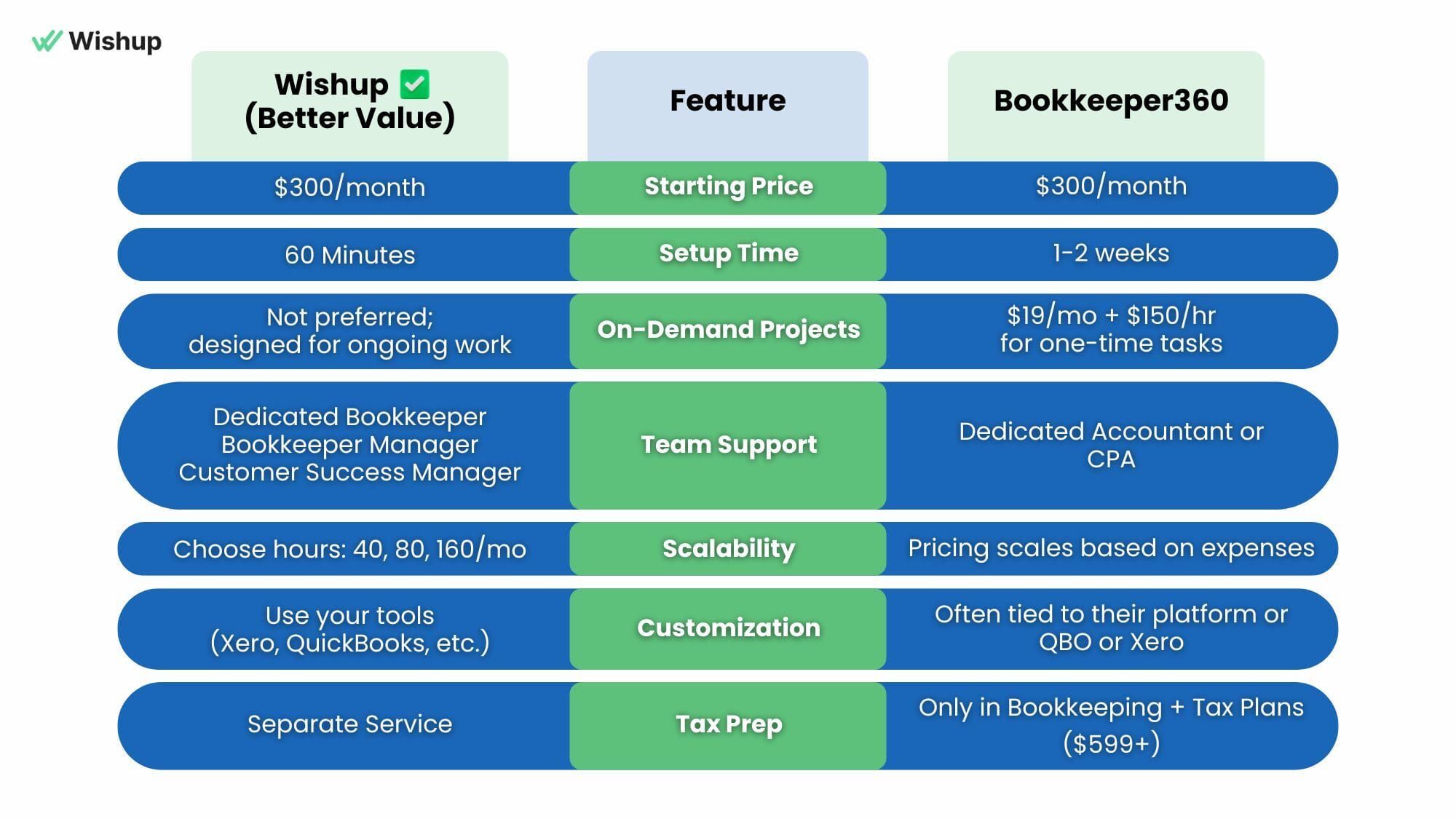

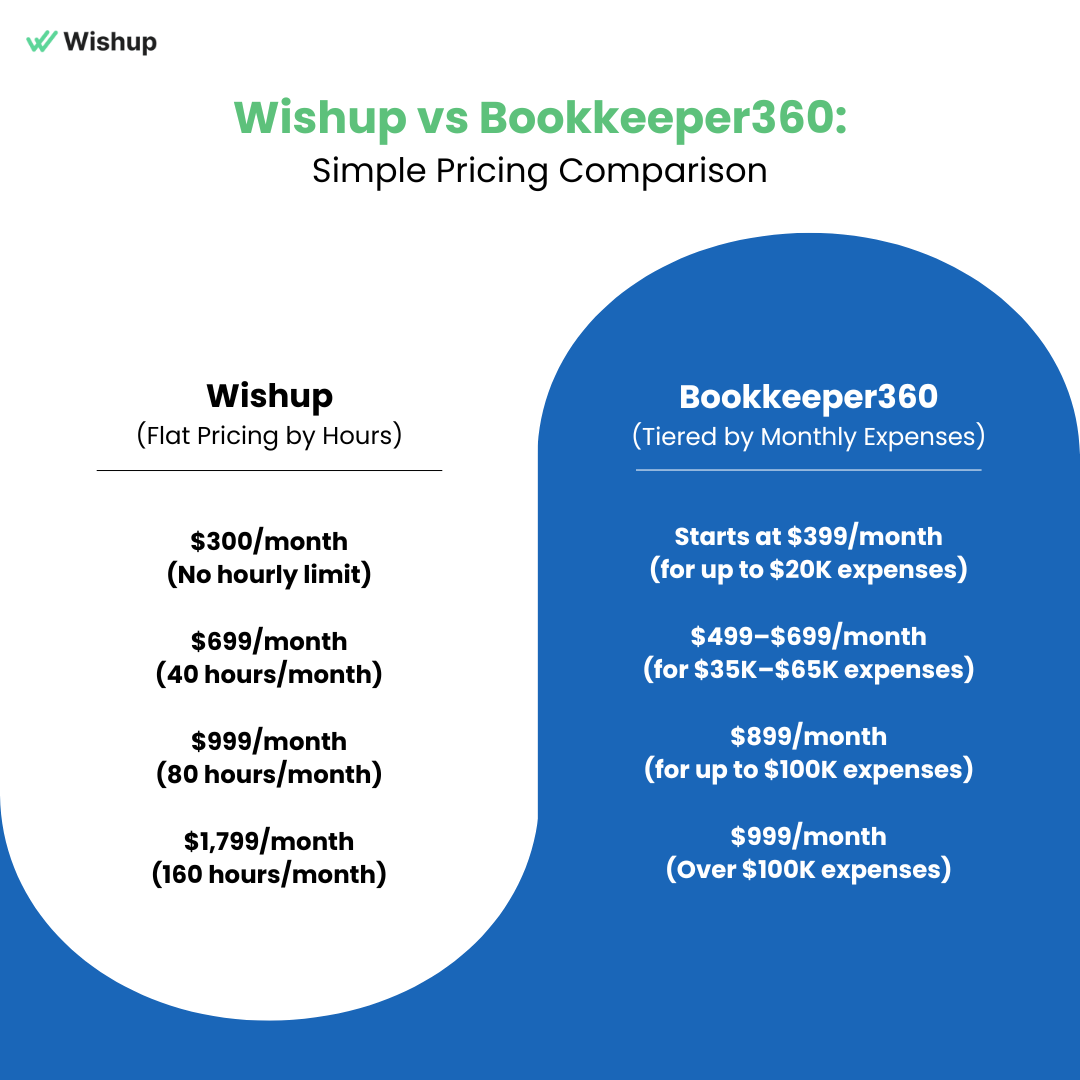

Bookkeeper360 offers several different pricing models depending on how big your business is. Wishup takes a different approach with transparent flat pricing, no matter how large or complex your operations are. This key difference is mostly overlooked by businesses.

Wishup’s flat-rate model is ideal for founders who value simplicity, predictability, and zero billing surprises. Bookkeeper360’s tiered structure can work well for businesses that are comfortable with packages that vary based on evolving financial size.

👉 Want a detailed breakdown of pricing and plans? Click here to jump to the full comparison.

Service Overview

Wishup: 500+ certified bookkeepers with 3-10 years of experience

Wishup offers personal and full-service bookkeeping services through highly vetted and trained virtual bookkeepers who live inside QuickBooks, Xero, and even spreadsheets — yes, they meet you where you are. With over 500+ certified bookkeeping experts, each with 3 to 10 years of hands-on experience in U.S. bookkeeping standards, this isn’t a generic service; it’s built for serious entrepreneurs who want accurate, real-time control over their numbers.

Wishup integrates with 15+ popular accounting tools like QuickBooks, Gusto, FreshBooks, Xero, and Sage, and supports businesses in 55+ industries from bookkeeping for travel agencies and homebuilders to bookkeeping for therapists, CPAs, and nonprofits.

Whether you need bookkeeping for freelancers, startups, cleaning businesses, lawyers, or churches, you’ll get a dedicated virtual bookkeeper, a proactive account manager, and a senior bookkeeping manager — all working in sync to deliver audit-ready books, cash flow clarity, and total compliance.

Our small business bookkeeping service doesn’t end at recording transactions. From expense tracking, invoice management, payroll support, federal/state tax prep (1040, 1065, 1120, 1120S), to W-2s, W-9s, 1099s, we handle it all. You can also hire a bookkeeping assistant to help with your accounting system setup, cash flow forecasting, or GAAP and IFRS compliance. In short, it’s bookkeeping & accounting made easy.

And here’s what founders love most — you can onboard in just 60 minutes, with no complex contracts, instant replacements, and a 7-day money-back guarantee. Our model is built for scale, flexibility, and speed, exactly what you need in a fast-paced business landscape. Our certified virtual bookkeepers cover everything that comes under the job description of a bookkeeper.

Bookkeeper360: End-to-end bookkeeping services

Bookkeeper360 is a well-known name in the bookkeeping and accounting services space. Designed as a financial technology solution, it offers a more traditional approach with a U.S.-based team and a proprietary dashboard that provides real-time insights into your finances. Their service covers bookkeeping, payroll, CFO advisory, tax, and R&D tax credit support, primarily designed for industries like SaaS, eCommerce, healthcare, real estate, and crypto.

If you're looking for a full-service bookkeeping service with detailed monthly financial reporting, Bookkeeper360 delivers. Their team handles accrual basis accounting, monthly check-ins, and tax advisory, and integrates with platforms like Gusto, Bill.com, and Expensify. However, the service is heavily tied to QuickBooks and Xero, meaning you’ll need to separately subscribe to those tools.

One thing to keep in mind is the onboarding timeline — setup takes 1–2 weeks. Also, while they offer great support for businesses with significant expense flows, their pricing model scales with your monthly business expenses. If your business expenses increase, your bookkeeper services for small business pricing will too, sometimes significantly.

Bookkeeper360 Pricing vs Wishup Pricing

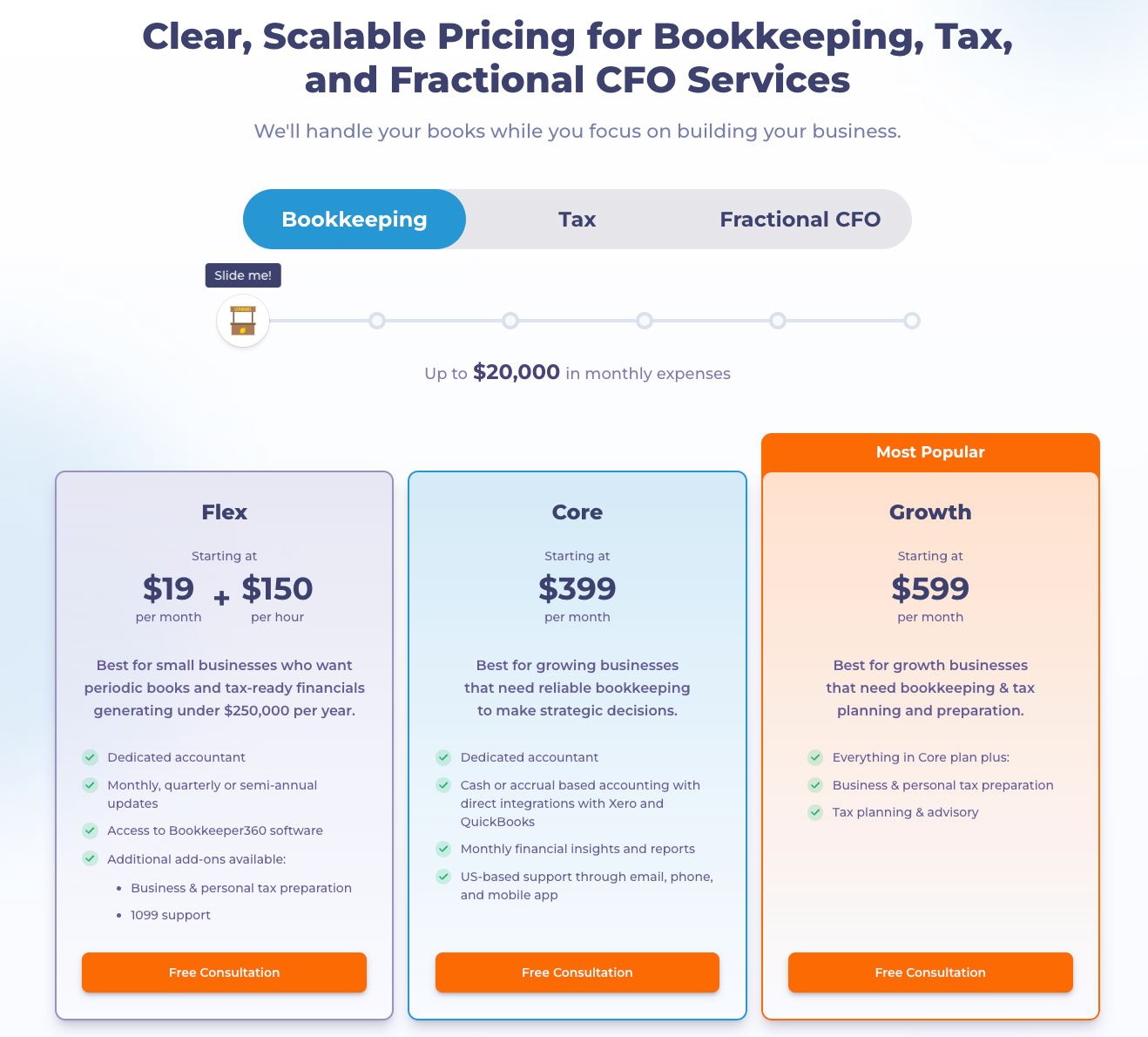

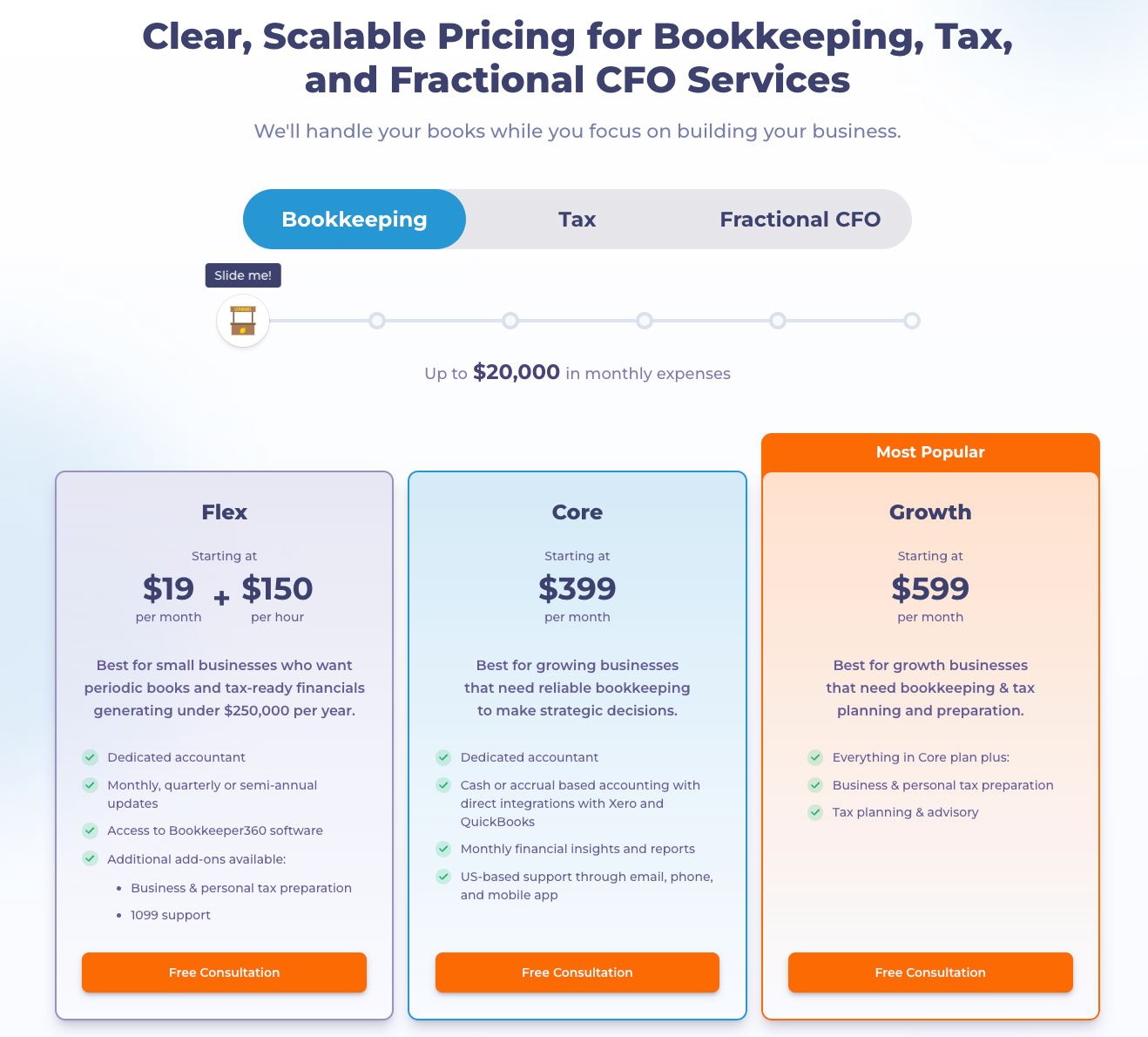

Bookkeeper360 uses a tiered pricing model based on business size and service type. The base plan starts at $19/month with $150/hour for on-demand support. This Pay-As-You-Go model is best for one-time projects like historical cleanup or backdated books, typically starting at $1,000.

You get a dedicated accountant, but the hourly rate makes this option expensive for ongoing use. It's ideal for occasional tasks, not continuous support. Long-term use means consistently paying premium hourly fees.

For monthly bookkeeping, Bookkeeper360 offers fixed packages starting at $399/month. If your monthly business expenses are under $20,000, you’re in the base tier. As expenses rise, pricing scales: $899/month for up to $100,000 in expenses, and $999/month for anything higher.

Here’s a quick breakdown of the Bookkeeper360 pricing tiers:

| Bookkeeper360 Pricing Plans | ||

|---|---|---|

| Monthly Business Expenses | Bookkeeping Only | Bookkeeping + Tax |

| Up to $20,000 | $399/month | $599/month |

| Up to $35,000 | $499/month | $699/month |

| Up to $50,000 | $599/month | $799/month |

| Up to $65,000 | $699/month | $899/month |

| Up to $100,000 | $899/month | $1,099/month |

| Over $100,000 | $999/month | $1,199/month |

If you want Bookkeeper360 to manage your bookkeeping along with tax preparation and strategic advisory, you’ll need to choose one of their “Bookkeeping + Tax” pricing plans. These start at $599/month for smaller businesses and go up to $1,199/month for larger operations. These higher-tier packages include a dedicated CPA in addition to your accountant, and cover services like cash or accrual basis reports, monthly financial statements, tax prep for business and personal returns, and CFO-style advisory support.

Additional services such as payroll, sales tax filing, and back-office software integrations can be added. These extras bring in additional costs, depending on your setup and frequency of service.

So while Bookkeeper360 offers highly detailed and professional bookkeeping, the pricing structure is segmented and scales quickly with your expense level. This means that as your business grows, your monthly price could also increase. Also, since the platform revolves around QuickBooks, you’ll need a separate subscription (which starts at $30/month), another recurring cost to factor in.

📘 Related Resource

Check out our in-depth guide on hourly bookkeeping rates in 2025 .

What makes Wishup pricing a smarter, more flexible choice?

Wishup takes a different approach, built around accessibility, transparency, and simplicity. The first thing you'll notice about Wishup is that we don't complicate pricing with multiple tiers based on your revenue. Instead, we give you a straightforward way to get expert bookkeeping help, whether you’re just starting or already running a growing business.

There are two primary service models at Wishup.

#1 Managed Bookkeeping:

Pricing starts at just $300/month. This is a perfect entry point for solopreneurs and small business owners who don’t want to hire a full-time bookkeeper but still need clean, compliant books. You get full day-to-day financial management, including handling payables and receivables, monthly and annual reports, and transparent, GAAP-compliant data that makes decision-making easy and stress-free.

#2 Dedicated Virtual Bookkeeper:

It is designed for businesses that need more hands-on help. Here, you choose how many hours of support you need per month. If you’re looking for part-time help, the 40-hour plan costs you $699/month. If your operations are growing and you need a steady hand throughout the month, the 80-hour plan at $999/month offers great value.

And for high-volume businesses, the 160-hour plan gives you full-time support at $1,799/month. Each plan comes with a dedicated bookkeeper who works like an extended part of your team, and you also get a Bookkeeper Manager and a Client Success Consultant who ensures nothing falls through the cracks.

What makes Wishup stand out is how human and flexible our service feels. You don’t just get a bookkeeper, you get a team that works with you. You can start small and upgrade your support hours anytime, without hidden fees or rigid structures. Our experts don’t take over your accounting tools; you retain full ownership and access, with them working on your preferred platform (QuickBooks, Xero, or otherwise) using read-only access for safety.

Who Has a Faster Hiring Process?

60-Minute Onboarding with Wishup.

When you’re running a fast-moving business, time is money. With Wishup, you can go from “I need a bookkeeper” to “my books are in order” in just 60 minutes. That includes discovering the right expert, reviewing their credentials, and kicking off your first task — all the same day.

Onboarding with Bookkeeper360.

Bookkeeper360 takes 1–2 weeks to get started.

👉 With Wishup’s lightning-fast onboarding:

- You skip the back-and-forth.

- You meet your dedicated virtual bookkeeper instantly.

- You start seeing financial impact within hours, not weeks.

If agility matters to your business, those two lost weeks could cost you way more than just time.

Free Trials

Wishup offers a 7-day guarantee option

Making a financial decision for your business is no small task, especially when it involves sensitive matters like bookkeeping. That’s why Wishup offers a 7-day money-back guarantee — no strings, no risks.

It’s our way of saying: “We’re confident in our value. You don’t have to take our word for it — try us.”

Does Bookkeeper360 offer free trials?

Bookkeeper360 doesn’t offer a trial period. You’ll have to lock into a monthly or annual contract upfront. For a 7-day trial, check Wishup.

Hiring Process

Wishup only hires the top 0.1% of bookkeepers

At Wishup, we don’t just hire bookkeepers, we curate elite financial operators. Our vetting process is rigorous, multi-staged, and founder-focused. Out of thousands of applicants, only the top 0.1% become a part of our bookkeepers clan. Here's a breakdown of our selection pipeline:

- Aptitude Test

- Written Test

- Resume + Application Screening

- Practical Assignment

- Interview

- Background Verification

- 4-Week Training Completion

This results in ultra-vetted experts who are not only fluent in U.S. accounting standards but trained to hit the ground running — no hand-holding required.

How does Bookkeeper360 hire a bookkeeper?

Bookkeeper360 shares no public information about its vetting process. For more details, you can reach out to them directly.

Tech Advantage

Wishup’s All-in-One Bookkeeping App

Managing your bookkeeping team shouldn’t require spreadsheets, Slack threads, or late-night calls. That’s why Wishup built an all-in-one app specifically for small and midsize business owners who demand visibility and control.

With the free Wishup Virtual Assistant App, you can:

- Track tasks in real time

- Review detailed end-of-day reports

- Give instant feedback

- Approve or reject time-off requests

- Bookmark high-priority financial tasks

- View, filter, and manage team performance

- Onboard new talent in under 60 minutes

- Access our full network of elite virtual bookkeepers from your phone

And yes, it’s available 365 days a year on Android and iOS.

Bookkeeper360: No public info on tracking

The publicly available information does not mention any tracking applications. You can check directly with their team for more information.

Decision Made? - Wishup or Bookkeeper360?

If you’re a founder in 2025, the way you manage your books can define your growth, your funding decisions, and your peace of mind.

Bookkeeper360 offers traditional bookkeeping with solid infrastructure. With Wishup, you get top 0.1% global bookkeeping talent trained in U.S. standards, guaranteed delivery, and a pricing structure that remains the same even when you grow.

Whether you’re a solo founder managing invoices or a team handling multi-state taxes, you get

- A full-stack bookkeeping team (not just a solo virtual bookkeeper)

- 250+ certified bookkeepers to hire from

- Real-time financial clarity

- Fixed, transparent pricing even when your business grows

- Same-day onboarding in 60 Minutes

- 7-day money-back guarantee trial

- Triple-vetted and trained bookkeepers

- Support for 51+ industries

- Cash basis or accrual basis accounting

- 100% audit-ready books, always

If you'd like to hire a Wishup bookkeeping virtual assistant, schedule a free consultation and hire your bookkeeper in just 60 minutes.